Earn Your MBA and DBA in Just 24 Months

Designed for ambitious professionals, it delivers a rigorous, fast-track pathway to both master’s and doctoral qualifications, combining academic excellence with real-world business application.

Curriculum Highlights

The initial phase focuses on core business disciplines, encompassing modules in finance, marketing, operations, and leadership essentials, providing a solid foundation in managerial expertise.

Building upon the MBA framework, the program seamlessly transitions into the DBA phase, where students delve into advanced research methodologies, innovative business theories, and strategic leadership frameworks.

Accelerated Learning

Our 24-month structure optimizes learning efficiency, ensuring a rigorous yet manageable pace for professionals seeking to enhance their skill set without compromising on quality or depth of education.

MBA/DBA Research

Culminating the program, students engage in a comprehensive postgraduate research that synthesizes their MBA and DBA learnings, demonstrating mastery in both practical application and academic research.

Real-world Application

Every module integrates real-world case studies, interactive projects, and industry-relevant simulations, allowing students to apply theoretical knowledge directly to practical business scenarios.

Flexibility and Accessibility

Despite the accelerated nature of the program, we prioritize flexibility, offering both full-time and part-time study options to accommodate diverse professional schedules.

This 24-month MBA/DBA dual degree is a transformative educational journey meticulously crafted to propel professionals toward unparalleled career growth and leadership excellence.

Curriculum Outline

MBA Modules

Module 1: International Management

| Topic | Description |

|---|---|

| 1.1 Hofstede’s Cultural Framework | Explore Hofstede’s dimensions of culture and their impact on international business practices. |

| 1.2 The GLOBE Framework | Examine the GLOBE study and its relevance to global management. |

| 1.3 Cultural Stereotyping and Social Institutions | Analyze the effects of cultural stereotypes and social institutions on international business. |

| 1.4 Cross-Cultural Assignments | Engage in assignments to develop cross-cultural management skills. |

| 1.5 Strategies for Expanding Globally | Learn strategies for international market expansion. |

| 1.6 The Necessity of Global Markets | Understand the importance of participating in global markets. |

| 1.7 Assessment | Exam |

Module 2: Marketing Management

| Topic | Description |

|---|---|

| 2.1 The Marketing Concept | Understand the foundational principles of marketing. |

| 2.2 Marketing Strategy | Develop effective marketing strategies and plans. |

| 2.3 Developing a Marketing Mix | Create a balanced marketing mix tailored to market needs. |

| 2.4 Buyer Behavior | Analyze factors influencing consumer purchasing decisions. |

| 2.5 Market Segmentation | Study methods for segmenting markets and targeting consumer groups. |

| 2.6 What is a Product? | Define different types of products and their market roles. |

| 2.7 Creating Products That Deliver Value | Design products that meet customer needs. |

| 2.8 The Product Life Cycle | Learn about the stages of the product life cycle. |

| 2.9 Pricing Strategies | Explore various pricing strategies and their impact. |

| 2.10 Trends in Developing Products and Pricing | Examine current trends in product development and pricing. |

| 2.11 Assessment | Exam |

Module 3: Accounting

| Topic | Description |

|---|---|

| 3.1 Introduction | Overview of accounting principles and their importance. |

| 3.2 The Accounting Profession | Explore the roles and responsibilities of accounting professionals. |

| 3.3 Basic Accounting Procedures | Learn fundamental accounting procedures and practices. |

| 3.4 The Balance Sheet | Understand the structure and components of a balance sheet. |

| 3.5 The Income Statement | Analyze the income statement and its role in financial reporting. |

| 3.6 Cash Flow Statement | Study the cash flow statement and its importance. |

| 3.7 Analyzing Financial Statements | Develop skills to interpret financial statements. |

| 3.8 Trends in Accounting | Examine current trends and developments in accounting. |

| 3.9 Assessment | Exam |

Module 4: Financial Management

| Topic | Description |

|---|---|

| 4.1 Introduction | Overview of financial management principles. |

| 4.2 How Organizations Use Funds | Explore how businesses allocate and utilize financial resources. |

| 4.3 Obtaining Short-Term Financing | Learn methods for securing short-term funding. |

| 4.4 Raising Long-Term Financing | Understand strategies for acquiring long-term capital. |

| 4.5 Equity Financing | Study options like issuing stock and venture capital. |

| 4.6 Securities Markets | Overview of securities markets and their role. |

| 4.7 Buying and Selling at Securities Exchanges | Learn about trading securities on exchanges. |

| 4.8 Trends in Financial Management and Securities Markets | Examine current trends in financial management. |

| 4.9 Assessment | Exam |

Module 5: Human Resource Management

| Topic | Description |

|---|---|

| 5.1 Achieving High Performance | Strategies for enhancing performance and productivity. |

| 5.2 Employee Recruitment | Best practices for attracting and sourcing candidates. |

| 5.3 Employee Selection | Techniques for evaluating and choosing candidates. |

| 5.4 Employee Training and Development | Approaches to developing employee skills. |

| 5.5 Performance Planning and Evaluation | Methods for assessing performance and providing feedback. |

| 5.6 Employee Compensation and Benefits | Understanding compensation structures and benefits. |

| 5.7 The Labor Relations Process | Overview of labor relations and negotiations. |

| 5.8 Managing Grievances and Conflicts | Techniques for resolving grievances and conflicts. |

| 5.9 Legal Environment of Human Resources and Labor Relations | Knowledge of relevant laws and regulations. |

| 5.10 Trends in Human Resources | Current trends in HR management. |

| 5.11 Assessment | Exam |

Module 6: Supply Chain and Distribution

| Topic | Description |

|---|---|

| 6.1 The Nature of Distribution | Explore the role of distribution in the supply chain. |

| 6.2 Wholesaling | Understand wholesale distribution functions and strategies. |

| 6.3 Retailing | Study retail methods, store management, and consumer strategies. |

| 6.4 Using Supply Chain to Increase Efficiency | Learn to optimize supply chain processes. |

| 6.5 Assessment | Exam |

DBA Modules

Module 1: Strategic Analysis

| Topic | Description |

|---|---|

| 1.1 Introduction to Strategic Analysis | Overview of strategic analysis and its role in business strategy development. |

| 1.2 SWOT Analysis | Explore the SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis technique. |

| 1.3 External Macro Environment | Examine external macroeconomic factors affecting businesses. |

| 1.4 Internal Analysis | Analyze internal factors and resources impacting organizational strategy. |

| 1.5 Business Strategies | Learn about various business strategies and their applications. |

| 1.6 Assessment | Exam |

Module 2: Strategic Management Process

| Topic | Description |

|---|---|

| 2.1 Introduction to Corporate Structure and Governance | Explore the fundamentals of corporate structure and governance mechanisms. |

| 2.2 Agency Problems and Issues | Analyze common agency problems and conflicts between stakeholders and management. |

| 2.3 Role of Management | Understand the critical role of management in the strategic management process. |

| 2.4 Investor Relations | Learn about managing investor relations and communication with stakeholders. |

| 2.5 Assessment | Exam |

Module 3: Financial Forecasting

| Topic | Description |

|---|---|

| 3.1 The Importance of Forecasting | Understand the role and significance of financial forecasting in business planning. |

| 3.2 Forecasting Sales | Techniques for predicting future sales based on historical data and market trends. |

| 3.3 Pro Forma Financials | Learn how to create pro forma financial statements for planning and analysis. |

| 3.4 Generating the Complete Forecast | Develop a comprehensive financial forecast covering all key aspects. |

| 3.5 Forecasting Cash Flow | Methods for predicting cash flow to manage liquidity and financial stability. |

| 3.6 Forecasting Using Excel | Utilize Excel tools and functions for accurate financial forecasting. |

| 3.7 Assessment | Exam |

Module 4: Risk Management

| Topic | Description |

|---|---|

| 4.1 Introduction to Investment Analysis | Overview of investment analysis and its importance in risk management. |

| 4.2 Measuring Risk | Techniques for quantifying and assessing risk in financial investments. |

| 4.3 Portfolio Size and Risk | Explore the relationship between portfolio size and associated risk levels. |

| 4.4 Average Return and Standard Deviation | Understand how average return and standard deviation are used to measure investment risk. |

| 4.5 Assessment | Exam |

Module 5: Information Risk and Insurance

| Topic | Description |

|---|---|

| 5.1 Introduction to Information Risk and Insurance | Overview of information risk and the role of insurance in managing this risk. |

| 5.2 Imperfect Information | Explore the concept of imperfect information and its impact on decision-making and risk management. |

| 5.3 How Insurance Works | Understand the mechanisms and principles behind insurance and its function in risk management. |

| 5.4 Adverse Selection | Analyze the concept of adverse selection and its implications for insurance markets. |

| 5.5 Assessment | Exam |

Module 6: International Trade

| Topic | Description |

|---|---|

| 6.1 Introduction to International Trade | Overview of international trade and its significance in the global economy. |

| 6.2 Absolute and Comparative Advantage | Explore the concepts of absolute and comparative advantage in international trade. |

| 6.3 How Opportunity Cost Sets Boundaries of Trade | Understand how opportunity cost influences trade boundaries and decisions. |

| 6.4 Economies of Scale and International Trade | Learn how economies of scale impact international trade practices and competitiveness. |

| 6.5 Assessment | Exam |

Module 7: Globalization and Protectionism

| Topic | Description |

|---|---|

| 7.1 Introduction to Globalization | Overview of globalization and its impact on international business and economies. |

| 7.2 Theories of Globalization | Explore various theories explaining the drivers and effects of globalization. |

| 7.3 Protectionism and Trade Barriers | Understand the concepts of protectionism and different types of trade barriers. |

| 7.4 Impact of Protectionism on Global Trade | Analyze how protectionist policies affect global trade and international relations. |

| 7.5 Balancing Globalization and Protectionism | Learn strategies for balancing the benefits of globalization with the need for protectionist measures. |

| 7.6 Assessment | Exam |

Module 8: Doctoral Research

| Topic | Description |

|---|---|

| 8.1 Doctoral Research Writing | Design and structure doctoral-level research papers and dissertations. |

Career Options After Graduation

MBA/DBA graduates possess advanced business knowledge and leadership skills, making them well-suited for a variety of leadership roles. Here are four leadership roles that MBA/DBA graduates can pursue:

Corporate Finance Manager

Average Salary: $85,000 – $130,000 per year

Marketing Manager

Average Salary: $80,000 – $120,000 per year

Management Consultant

Average Salary: $90,000 – $150,000 per year

Investment Banker

Average Salary: $100,000 – $200,000 per year (plus potential bonuses)

Operations Manager

Average Salary: $75,000 – $115,000 per year

Others

Degree Certificates

Upon successfully completing the dual Master of Business Administration (MBA) and Doctorate of Business Administration (DBA) program, graduates receive two distinct certificates: an MBA degree certificate and a DBA degree certificate, along with official transcripts for both degrees.

MBA Certificate

This certificate signifies a high level of expertise in business management and strategy, enhancing career prospects and opening doors to advanced professional opportunities.

DBA Certificate

This prestigious certificate represents the highest academic achievement in business administration. Graduates are entitled to use the honorific title “Dr.” before their name, reflecting their advanced scholarly accomplishments and research expertise.

Official Transcript of Records

Graduates of the MBA/DBA program are awarded an official transcript of records, issued by the institution as formal recognition of their academic performance and program completion.

Students who successfully complete their program will be conferred an official certificate with a unique serial number and signature of the university president and executive dean. To verify your certificate, submit it to official@hallford.education.

Frequently Asked Questions (FAQs)

Complete Your Enrollment at Hallford University

Join an international community of business leaders. Finalize your enrollment to begin your Hallford University experience. Secure your seat and receive your student access within 24 hours.

HEAR FROM OUR STUDENTS

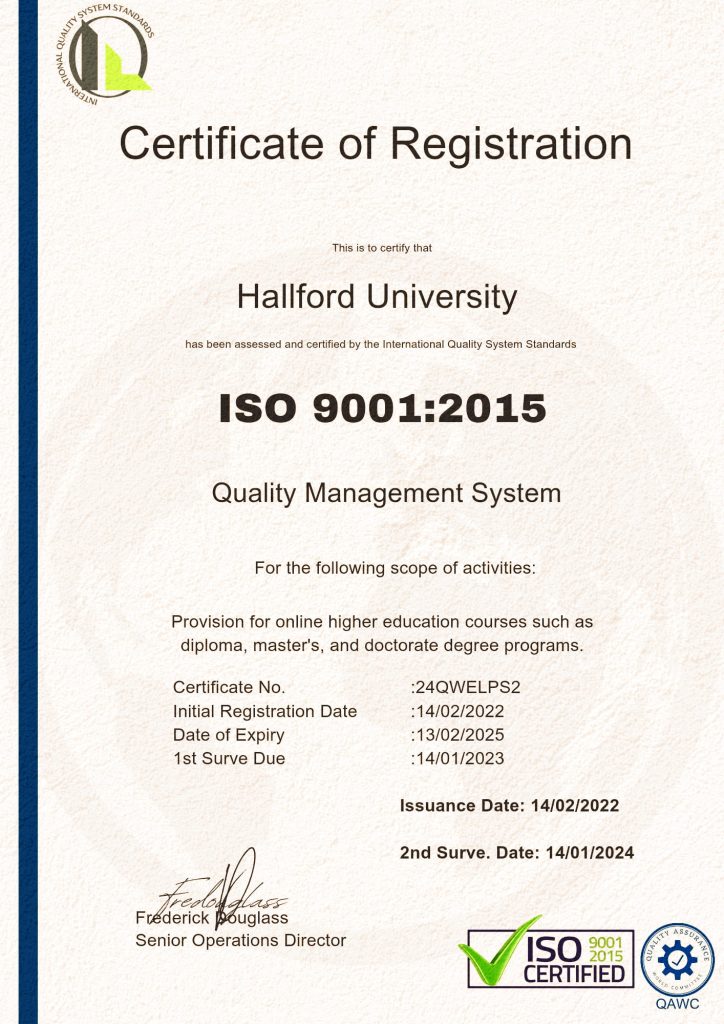

Accreditations

At Hallford University, we’re thrilled to share that we are an ISO 9001: 2015 certified organization and accredited by the International Board for Higher Education. These recognitions is like a badge of honor for us, and it signifies our deep commitment to providing top-notch education.

You might be wondering, what does accreditation really mean? Well, it’s like a seal of approval from experts in the field of education. They’ve taken a close look at our programs, our faculty, and our overall operations, and they’ve given us a big thumbs-up. It’s a way of saying that we’re doing things the right way and maintaining high standards.

This accreditation isn’t just a piece of paper; it’s a reflection of the hard work and dedication of our entire team, from our educators to our support staff. We’re all in this together, with one goal in mind: to provide you, our students, with an outstanding education.

IBHE Certificate of Accredition

What it means for you is that when you choose Hallford University, you’re choosing an institution that’s been recognized for its commitment to quality. You can trust that the education you receive here meets or even exceeds the standards set by experts in the field.

So, when you embark on your educational journey with us, know that you’re not just enrolling in a university; you’re joining a community of learners dedicated to helping you achieve your academic and professional goals. We’re here to support you every step of the way, and our accreditation is a testament to our promise of delivering a world-class education to learners from all walks of life.