Doctor of Business Administration

The ultimate distinction for visionary leaders and accomplished professionals who demand more than conventional success. Designed for those who aspire to redefine strategy, innovation, and leadership at the highest level, this prestigious doctoral program fuses academic rigor with real-world relevance.

What is a DBA?

Guided by renowned faculty and thought leaders, candidates engage in advanced research that transforms complex business challenges into actionable insight. The program cultivates intellectual authority, strategic foresight, and evidence-based leadership, empowering graduates to influence boardrooms, universities, and global markets alike.

Earning a DBA is not just an academic achievement, it is a mark of mastery, signifying the rare capability to bridge research, leadership, and impact in today’s dynamic business world.

Who is this for?

The Doctor of Business Administration (DBA) is the ultimate credential for visionary leaders who seek to turn experience into influence. Designed for accomplished executives and entrepreneurs, the program blends advanced research with real-world strategy—equipping professionals to solve complex business challenges and shape the future of global leadership.

Earning a DBA is more than an academic milestone—it’s a mark of distinction that defines those who lead with insight, innovate with purpose, and inspire change at the highest level.

Online DBA

The Online Doctor of Business Administration (DBA) is a prestigious doctoral degree designed for accomplished professionals who seek to achieve the highest level of business mastery without interrupting their careers. Equivalent in academic rigor and credibility to an on-campus doctorate, the Online DBA combines advanced research, strategic leadership, and real-world application in a flexible digital learning environment.

This elite program allows executives, entrepreneurs, and senior managers to engage with global faculty, collaborate with peers from diverse industries, and conduct research that drives innovation and impact. With the same academic standards and accreditation as traditional programs, the Online DBA delivers a powerful blend of academic excellence, professional relevance, and global recognition.

Whether pursued online or in person, the DBA is a mark of distinction, a testament to one’s ability to think critically, lead strategically, and contribute original insights to the world of business.

Course Content

Module 1: Strategic Analysis

| Topic | Description |

|---|---|

| 1.1 Introduction to Strategic Analysis | Overview of strategic analysis and its role in business strategy development. |

| 1.2 SWOT Analysis | Explore the SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis technique. |

| 1.3 External Macro Environment | Examine external macroeconomic factors affecting businesses. |

| 1.4 Internal Analysis | Analyze internal factors and resources impacting organizational strategy. |

| 1.5 Business Strategies | Learn about various business strategies and their applications. |

| 1.6 Assessment | Exam |

Module 2: Strategic Management Process

| Topic | Description |

|---|---|

| 2.1 Introduction to Corporate Structure and Governance | Explore the fundamentals of corporate structure and governance mechanisms. |

| 2.2 Agency Problems and Issues | Analyze common agency problems and conflicts between stakeholders and management. |

| 2.3 Role of Management | Understand the critical role of management in the strategic management process. |

| 2.4 Investor Relations | Learn about managing investor relations and communication with stakeholders. |

| 2.5 Assessment | Exam |

Module 3: Financial Forecasting

| Topic | Description |

|---|---|

| 3.1 The Importance of Forecasting | Understand the role and significance of financial forecasting in business planning. |

| 3.2 Forecasting Sales | Techniques for predicting future sales based on historical data and market trends. |

| 3.3 Pro Forma Financials | Learn how to create pro forma financial statements for planning and analysis. |

| 3.4 Generating the Complete Forecast | Develop a comprehensive financial forecast covering all key aspects. |

| 3.5 Forecasting Cash Flow | Methods for predicting cash flow to manage liquidity and financial stability. |

| 3.6 Forecasting Using Excel | Utilize Excel tools and functions for accurate financial forecasting. |

| 3.7 Assessment | Exam |

Module 4: Risk Management

| Topic | Description |

|---|---|

| 4.1 Introduction to Investment Analysis | Overview of investment analysis and its importance in risk management. |

| 4.2 Measuring Risk | Techniques for quantifying and assessing risk in financial investments. |

| 4.3 Portfolio Size and Risk | Explore the relationship between portfolio size and associated risk levels. |

| 4.4 Average Return and Standard Deviation | Understand how average return and standard deviation are used to measure investment risk. |

| 4.5 Assessment | Exam |

Module 5: Information Risk and Insurance

| Topic | Description |

|---|---|

| 5.1 Introduction to Information Risk and Insurance | Overview of information risk and the role of insurance in managing this risk. |

| 5.2 Imperfect Information | Explore the concept of imperfect information and its impact on decision-making and risk management. |

| 5.3 How Insurance Works | Understand the mechanisms and principles behind insurance and its function in risk management. |

| 5.4 Adverse Selection | Analyze the concept of adverse selection and its implications for insurance markets. |

| 5.5 Assessment | Exam |

Module 6: International Trade

| Topic | Description |

|---|---|

| 6.1 Introduction to International Trade | Overview of international trade and its significance in the global economy. |

| 6.2 Absolute and Comparative Advantage | Explore the concepts of absolute and comparative advantage in international trade. |

| 6.3 How Opportunity Cost Sets Boundaries of Trade | Understand how opportunity cost influences trade boundaries and decisions. |

| 6.4 Economies of Scale and International Trade | Learn how economies of scale impact international trade practices and competitiveness. |

| 6.5 Assessment | Exam |

Module 7: Globalization and Protectionism

| Topic | Description |

|---|---|

| 7.1 Introduction to Globalization | Overview of globalization and its impact on international business and economies. |

| 7.2 Theories of Globalization | Explore various theories explaining the drivers and effects of globalization. |

| 7.3 Protectionism and Trade Barriers | Understand the concepts of protectionism and different types of trade barriers. |

| 7.4 Impact of Protectionism on Global Trade | Analyze how protectionist policies affect global trade and international relations. |

| 7.5 Balancing Globalization and Protectionism | Learn strategies for balancing the benefits of globalization with the need for protectionist measures. |

| 7.6 Assessment | Exam |

Module 8: Doctoral Research

| Topic | Description |

|---|---|

| 8.1 Doctoral Research Writing | Explore the principles and techniques of writing doctoral research, including structure, methodology, and presentation. |

Career Options After Graduation

MBA/DBA graduates possess advanced business knowledge and leadership skills, making them well-suited for a variety of leadership roles. Here are four leadership roles that MBA/DBA graduates can pursue:

Management Consultant

Role: Provides strategic advice to improve business performance and solve complex problems.

Average Salary: $90,000 – $150,000 per year

Investment Banker

Role: Assists with raising capital, advises on mergers and acquisitions, and handles financial restructuring.

Average Salary: $100,000 – $200,000 per year (plus potential bonuses)ort description.

Corporate Finance Manager

Role: Manages financial activities, including budgeting, forecasting, and financial analysis.

Average Salary: $85,000 – $130,000 per year

Marketing Manager

Role: Develops and implements marketing strategies to promote products or services and drive growth.

Average Salary: $80,000 – $120,000 per year

Operations Manager

Role: Oversees production and delivery, focusing on improving efficiency and effectiveness.

Average Salary: $75,000 – $115,000 per year

Others

An MBA is a versatile degree that opens doors to various other roles across different industries, including entrepreneurship, human resources, supply chain management, and more.

Degree Certificates

Upon successfully completing the Doctorate of Business Administration (DBA) program, graduates receive a DBA degree certificate, along with an official transcripts of records.

DBA Certificate

This prestigious certificate represents the highest academic achievement in business administration. Graduates are entitled to use the honorific title “Dr.” before their name, reflecting their advanced scholarly accomplishments and research expertise.

Official Transcript of Records

Graduates of the MBA/DBA program are awarded an official transcript of records, issued by the institution as formal recognition of their academic performance and program completion.

Students who successfully complete their program will be conferred an official certificate with a unique serial number and signature of the university president and executive dean. To verify your certificate, submit it to official@hallford.education.

Enrollment Form

HEAR FROM OUR STUDENTS

ACCREDITATIONS

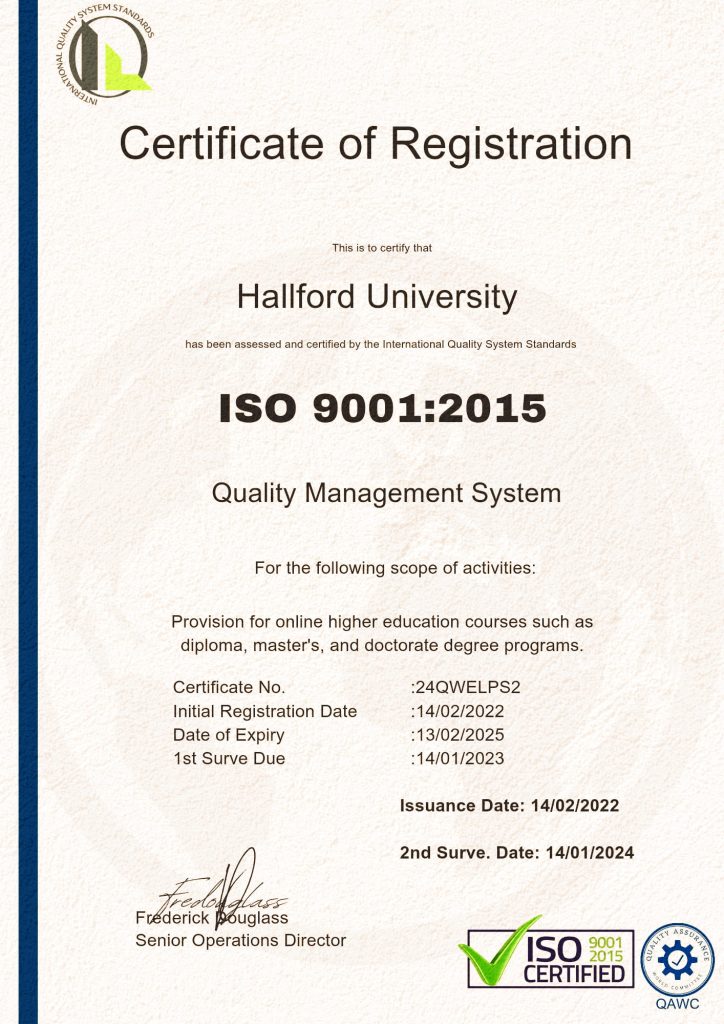

At Hallford University, we’re thrilled to share that we are an ISO 9001: 2015 certified organization and accredited by the International Board for Higher Education. These recognitions is like a badge of honor for us, and it signifies our deep commitment to providing top-notch education.

You might be wondering, what does accreditation really mean? Well, it’s like a seal of approval from experts in the field of education. They’ve taken a close look at our programs, our faculty, and our overall operations, and they’ve given us a big thumbs-up. It’s a way of saying that we’re doing things the right way and maintaining high standards.

This accreditation isn’t just a piece of paper; it’s a reflection of the hard work and dedication of our entire team, from our educators to our support staff. We’re all in this together, with one goal in mind: to provide you, our students, with an outstanding education.

IBHE Certificate of Accredition

What it means for you is that when you choose Hallford University, you’re choosing an institution that’s been recognized for its commitment to quality. You can trust that the education you receive here meets or even exceeds the standards set by experts in the field.

So, when you embark on your educational journey with us, know that you’re not just enrolling in a university; you’re joining a community of learners dedicated to helping you achieve your academic and professional goals. We’re here to support you every step of the way, and our accreditation is a testament to our promise of delivering a world-class education to learners from all walks of life.

learn more

-

Why 1 Year MBA Programs Online Are the Smartest Career Move This Year

January has a way of stirring reflection. The holidays fade, the coffee tastes a little stronger, and suddenly that job you were perfectly content with in November feels… constraining. You scroll LinkedIn, see former classmates posting about promotions, and wonder: Did I stall? If that sounds familiar, you’re not failing. You’re just paying attention. Increasingly,…

-

Closing the Year: Advancing Online Business Education for Professionals

Online MBA and DBA programs continue to reshape how professionals pursue advanced business education. As the year draws to a close, Hallford University reflects on a period of focused institutional development and steady progress in delivering online business programs for professionals who want credible qualifications without pausing their careers. The past year was not about…

-

Best 1 Year MBA Programs Online for Working Professionals (2025 Guide)

For experienced professionals who want to advance their careers without stepping away from For experienced professionals who want to advance their careers without stepping away from full-time work, 1 year MBA programs online—often referred to as a fast track online MBA programs—have become a popular option in 2025. As employers place greater emphasis on demonstrated…

-

Is an Online MBA Worth It in 2025? Real ROI, Salary & Career Data

Introduction: The MBA Dilemma in 2025 Let’s cut to the chase.In 2025, business professionals are standing at a crossroads.On one side: inflation, AI-driven job shifts, and a competitive global market.On the other: the promise of an Online MBA , flexible, remote, and career-boosting… supposedly. But is it actually worth it?Or just another expensive piece of…

-

Is an Online DBA Worth It? Here’s What You Need to Know

If you’re a business professional looking to advance your career, specialize in executive leadership, or transition into consulting or academia, pursuing an online Doctor of Business Administration (DBA) could be a game-changing move. But with so many options and opinions out there, one big question remains: Is an online DBA degree really worth it? Let’s…

-

The Importance of Lifelong Learning: Continuing Education at Hallford University

In today’s fast-paced, ever-changing world, one thing is clear: learning never stops. No matter your career stage or field of expertise, staying current with new skills, trends, and technologies is crucial to both personal and professional growth. At Hallford University, we believe in the power of lifelong learning, which is why we offer a wide range of continuing…